Economy · 27. February 2025

The recent rapid increase in the number of bankruptcies also has its good side: Among the companies that had to give up, many were zombie companies that were only able to survive for so long thanks to special circumstances and that damaged the economy.

Economy · 15. January 2025

Corporate insolvencies in Germany are rising for the third year in a row. At the end of 2024, a new record high of 22,400 bankrupt companies was recorded.

FEBIS · 31. May 2024

The new Code of Conduct and the adapted retention periods elaborated by the German Association “Die Wirtschaftsauskunfteien eV” (“DW”), which represents the interests of the major German credit reporting agencies, have been approved by the Data Protection Authority.

Economy · 30. April 2024

The mood of medium-sized businesses in Germany deteriorated further in spring 2024. This is shown by the current study by Creditreform Wirtschaftsforschung from Neuss, for which around 1,250 small and medium-sized companies were surveyed.

Economy · 15. March 2024

It was only a short interim high - in 2022 after the corona pandemic, the economy in Germany got going again. But with the outbreak of war in Ukraine, all hopes of a lasting recovery had to be buried.

Economy · 20. February 2024

War and crises have weakened economies worldwide - especially those of industrialized nations. While Europe and the USA are slowly recovering, Germany is lagging behind.

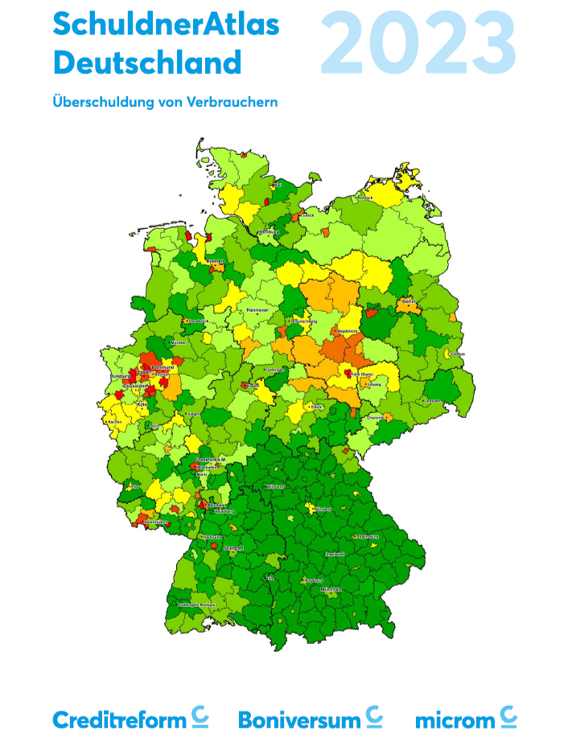

Economy · 15. November 2023

5.65 million citizens over-indebted / “hidden increase” in over-indebtedness / over-indebtedness ratio of 8.15 percent / trend reversal due to persistent inflation and high interest rates / recession as a driver of over-indebtedness

Market Monitor · 25. October 2023

Constricted by bureaucracy, unsettled by the economy and paralyzed by rising costs - Creditreform's current analysis of the economic situation and financing in medium-sized businesses shows very clearly: Companies in Germany are looking bleakly into the near future. They spend a lot of time and energy trying to cope with the general conditions instead of investing resources in further development. How long can this last?

Insolvencies · 23. March 2023

During the last year, 14,578 companies filed for insolvency in Germany. This represents an increase of 4.2 percent in corporate insolvencies in comparison to the same period of the previous year (2021: 13,991 corporate insolvencies).

Economy · 02. December 2022

For the analysis, CRIF examined almost 3 million companies in Germany with regard to their creditworthiness and financial strength.