Global businesses are showing resilience amid geopolitical tensions and supply chain disruptions, buoyed by a shift towards accommodative global monetary policies. This optimism extends to improved macroeconomic conditions, with businesses notably upbeat about sales and order growth. Financial as well as investor confidence has surged on expectations of favorable operating conditions and reduced borrowing costs in economies that are easing their monetary policies.

Optimism regarding global supply chain continuity has seen a turnaround after four quarters of consecutive declines, despite persistent vulnerabilities such as elevated shipping costs and climate-related disruptions. Additionally, the rebound in business ESG sentiment underscores renewed commitments to sustainability, with most surveyed businesses planning to increase their budget for ESG-related activities.

Key Findings

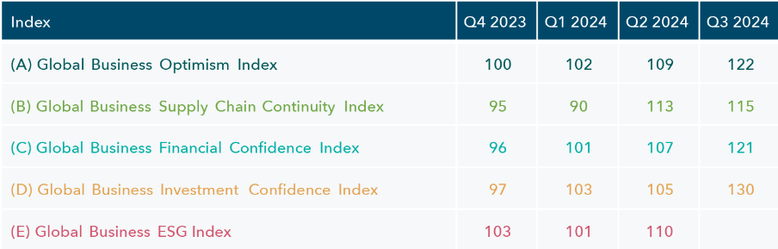

A. The Global Business Optimism Index increased 12.3% on the back of expected growth in sales, new orders, and favorable input costs amid easing global inflation.

B. The Global Supply Chain Continuity Index saw a marginal improvement of 1.2% stemming from businesses adjusting to the new supply chain environment, which continues to be disturbed by geopolitical tensions, longer shipping routes, and climate-related disruptions.

C. The Global Business Financial Confidence Index improved 12.3% as businesses are optimistic about their operating conditions and liquidity risk.

D. The Global Business Investment Confidence Index increased 23.3%, signaling a meaningful uptick in optimism for capital spending, backed by an accommodative global monetary policy.

E. The Global Business ESG Index increased 8.0% as businesses look to re-engage their sustainability initiatives. In the survey, more than one in two respondents indicated increased funding for ESG-related activities.

What is GBOI?

A comprehensive exploration of business optimism worldwide. The report delves into the aspirations and sentiments of business leaders to bring you a holistic perspective on the economic landscape.

Key Indices

Download Q3 2024 Report below:

Source: D&B

Write a comment