Constricted by bureaucracy, unsettled by the economy and paralyzed by rising costs - Creditreform's current analysis of the economic situation and financing in medium-sized businesses shows very clearly: Companies in Germany are looking bleakly into the near future. They spend a lot of time and energy trying to cope with the general conditions instead of investing resources in further development. How long can this last?

Complaining is part of the business, as anyone who has spoken to Germany's medium-sized companies in the last few weeks could easily say: Good employees? Hard to find. The energy costs? Way to high. Laws and requirements? An overwhelming number. Add to that the weak economy and high interest rates. All of this distracts from the actual business and prevents companies from developing healthily and sustainably. The increasing frustration of many entrepreneurs is already being described in the media as “business resignation”.

But one can also counter: “If you don’t sue, you don’t win.” After all, it is absolutely legitimate for SMEs to draw attention to their concerns, needs and problems. After all, according to the medium-sized business association BVMW, 3.5 million small and medium-sized companies in this country account for a good 60 percent of the net value added, 58 percent of all jobs and more than 80 percent of all training positions. They export goods and services worth 207 billion euros per year, more than 1,300 of them are global leaders in their niche. In short: the entrepreneurs who make their voices heard are actually the backbone of the German economy.

A backbone that has had to endure a lot over the past three years and has shown amazing resilience. But it also has its limits.

The mood is worse than it has been for a long time.

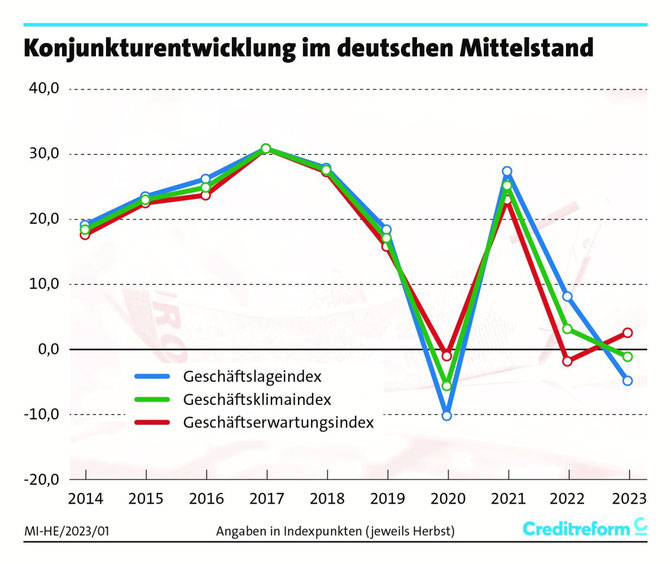

This is shown by the results of the current Creditreform analysis of the economic situation and financing in medium-sized businesses. Accordingly, medium-sized companies are currently assessing their situation as worse than it has been since the peak of the Corona crisis. The Creditreform business climate index, which reflects the mood of 1,200 companies surveyed, fell to minus 1.2 points in autumn 2023. Only once in the past ten years has the mood been worse, namely in autumn 2020.

In their current assessment, companies are pricing in what all major German economic research institutes now take for granted: in 2023, Germany will be the only country in the euro area with a shrinking GDP. In addition, there is the braking effect of structural problems: such as high energy costs, high interest rates, bureaucracy and a shortage of skilled workers. And there is still no belief that announced measures such as the Federal Government's Growth Opportunities Act or the EU Commission's SME relief package will provide tangible relief.

Sales and earnings are plummeting

Both relief and belief in it would be urgently needed. Because parallel to structural problems, economic pressure is increasing. While the order situation of the medium-sized companies surveyed by Creditreform was still positive in autumn 2022 - the books were filled long in advance - things are now looking poor.

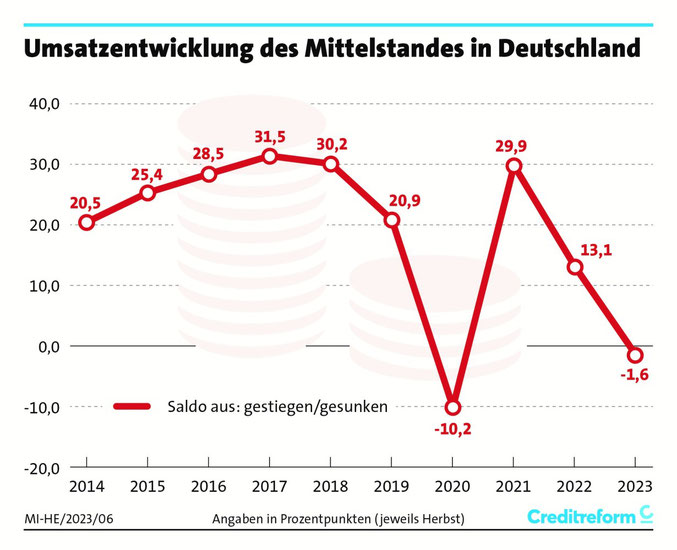

Almost one in three respondents (31.8 percent) reported a decline in orders and only 17.9 percent recorded an increase in order backlogs. Accordingly, companies' sales, earnings and employment figures have deteriorated compared to the previous year. Only a quarter (25.2 percent) were able to report an increase in sales, and even more (26.8 percent) had to accept losses in sales.

Willingness to invest severely dampened

The sharp increase in financing costs is also having an impact on the willingness to invest across all sectors. The proportion of companies that told Creditreform that they were planning an investment project fell from 46.2 percent to 38.4 percent. It is the lowest value in almost 20 years.

Things still looked really good in 2022. In the annual report on the KfW SME Panel , the development bank's economists report that companies' willingness to invest increased last year. At 15 percent, SMEs expanded their investment activity nominally even more than the entire corporate sector in Germany (10.4 percent).

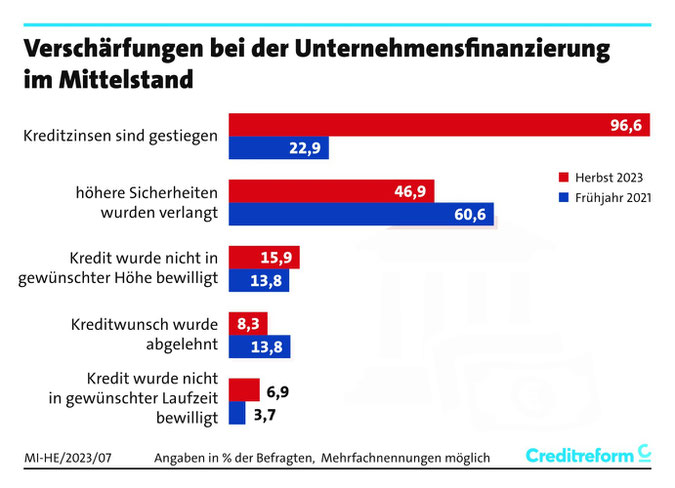

But this interim high is now over. The European Central Bank's restrictive course has reached companies. For years nothing was cheaper than the next loan, but now it has become really expensive again to borrow money. 96.6 percent of the companies surveyed by Creditreform perceive the increased loan interest rates as the biggest tightening in corporate financing - far ahead of other financing obstacles. Factors such as the loan amount or term hardly play a role. Only a significant proportion of SMEs (46.9 percent) experience stricter security requirements from banks.

When it comes to equity, the gap is widening

At least there is hope that a growing proportion of companies can approach their bank advisors very confidently when it comes to security. More companies than ever before have a very healthy equity ratio of more than 30 percent. It will be 36.9 percent in autumn 2023, which is an absolute record and the highest level since the survey began in 2014.

But unfortunately it is only one side of the coin. The proportion of those who have less than 10 percent equity in relation to total assets has also risen further to 28.3 percent. The result: the middle class is split into winners and losers. Companies with strong equity gains strength, while companies with weak equity become weaker.

This development was already foreseeable in the Creditreform analysis in the spring and it is continuing. After the corona pandemic, last year's energy crisis left a clear mark on the capital structure of many companies, which is likely to result in a negative spiral for some of them in the coming winter: Without equity, they can hardly cushion losses in economically difficult times, and their weak credit rating also makes it difficult access to outside capital. If external factors that threaten the business model are added, they actually risk running out of steam.

Source: Creditreform

Write a comment