An ageing demographic profile is often presented in negative terms. But while it undoubtedly presents macro-economic challenges to governments, the growing number of older people in Asian societies is also creating huge opportunities for businesses. Adrian Ashurst, CEO of Worldbox Intelligence, takes a look at the prospects for healthcare in particular.

The world is undergoing a revolution that will have a dramatic impact on economies and societies in the decades ahead. Yet while millions of words seem to be written and broadcast every year on issues such as the rise of China or how technological change will transform our lives, very little attention is given to the profound demographic changes that are taking place.

Indeed, many of the milestones that have already been reached simply aren’t reported. So, you probably didn’t know that in 2018, for the first time in history, persons aged 65 years or over outnumbered children under the age of 5. Or that by 2050, according to UN projections, one in six people in the world will be over the age of 65, up from one in eleven in 2019.(1)

Yet the implications of this revolution are profound, as the UN points out:

“Population ageing is poised to become one of the most significant social transformations of the twenty-first century, with implications for nearly all sectors of society, including labour and financial markets, the demand for goods and services, such as housing, transportation, and social protection, as well as family structures and intergenerational ties.”

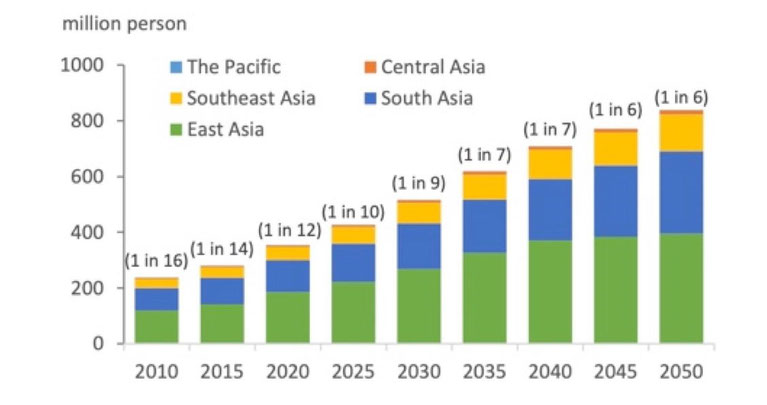

The degree of ageing varies across Asia. South Korea, Hong Kong and China are at an advanced stage of demographic transition, with an old-age dependency ratio of more than 22% in 2020, which is expected to rise to 64% by 2050. In the middle stage are India and Indonesia, with a 9% dependency ratio in 2020, which will increase to 20% by 2050.(2)

Figure 1: Proportion of Asian Population Aged 65 and Over by Region, 2010-2050

Source: United Nations Population Projections

https://population.un.org/wpp/Download/Standard/Population/ (accessed 15 January 2020)

The business opportunities

As people age, their spending habits change. They stop buying people-carriers to ferry the family around and likely opt for a smaller car. They are unlikely to spend as much on furniture, like sofas, since their home is already well furnished. They may well have much more disposable income, having paid off the mortgage and finished their pension contributions. So, they are likely to spend more on hobbies like gardening and golf, while travel is a favourite occupation.

Private healthcare at the beginning of a decades-long boom

Sadly, they will also be spending more on healthcare, and this will provide a huge business opportunity. Private healthcare is already a key player in some regions. In Southeast Asia, for example, private for-profit healthcare accounts for around 53% of the US$420bn healthcare market. It is also well entrenched in every country in the region, from Singapore to socialist Vietnam, with many parts of public health provision in the region having been privatised from the 1990s onwards.

Various factors are driving the growth of private healthcare provision in Asia. Clearly, as we have seen, the demand is there and will continue to grow rapidly as societies age and become more prosperous. Moreover, governments are struggling to deliver high-quality and sophisticated public services to the increasingly large and demanding urban middle class in Asia. Many people are prepared to pay for efficient, easily accessible and high-quality healthcare. Some are even willing to pay extra because expensive private hospitals are seen as status symbols. Health tourism from abroad is also driving demand: Southeast Asia alone earned US$8bn in revenue from 4 million people in pre-pandemic 2018.(3)

Moreover, in countries such as the Philippines, Indonesia and now India, the absence of public facilities is encouraging the development of private services for the relatively low paid, enabling access to basic healthcare services.

Keeping China healthy

China is clearly the biggest market for healthcare in the region, given the size of its population, and the potential for private insurers is huge. Around 95% of China’s population is covered by a public insurance programme, funded by voluntary and mandatory contributions.

However, private healthcare in the country is booming, with insurance premium growth of over 30% recorded for six consecutive years to the end of 2020, according to GenRe.(4) The direct reinsurer adds that the RMB 817.3bn (US$129.4bn) of premium recorded in 2020 is expected to grow to RMB 2 trillion (US$300bn) by 2025. Beijing is keen to encourage the development of private healthcare, via its “Healthy China” strategy, to alleviate the pressures of an ageing population on its healthcare systems.

Another jewel in the crown?

Meanwhile, the potential in India is vast. The Indian government spent just 1.3% of GDP on healthcare provision in 2019-20, a staggeringly low ratio. By comparison, the US spends 8.6%, Brazil 4% and China 2.9%. Moreover, while the Indian population grew by 13.3% (160 million people) between 2011 and 2020, spending on healthcare rose by just 0.39% over the same period. Private healthcare is stepping up to fill the gap left by the public sector. Indeed, private healthcare (households, non-profit organisations, and corporations) accounted for well over two-thirds of total healthcare spending in 2019-20.

Currently, private healthcare is mainly the preserve of relatively affluent Indians(5) . Up to 80.9% of people in urban India and 86% in rural areas lack any health coverage. Like China, the government is keen to encourage the development of private healthcare. The New Health Policy of 2017 provides for universal health coverage and “strategically purchasing” private infrastructure. In 2018, the Modi government launched “Modicare”, intended to provide access to healthcare for 40% of the poorest Indians.

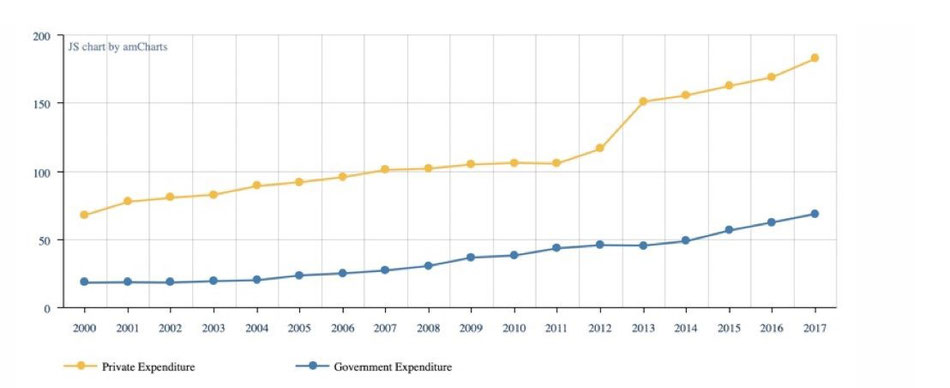

As Figure 2 highlights, private expenditure on healthcare in India has begun to accelerate, largely driven by the newly affluent middle class. As coverage extends to lower-paid workers, and as the middle class grows in size, spending on private healthcare could accelerate dramatically in the coming decades.

Figure 2: India – Domestic General Government Health Expenditure and Domestic Private Health Expenditure per Capita PPP (US$), 2000-2017

Source: WHO Global Health Observatory

It is clear from looking at the healthcare sector alone that ageing societies could provide a bonanza for the private sector in the coming decades. Many governments recognise that and are adopting policies to encourage private-sector involvement from both domestic and foreign sources.

1. World Population Prospects 2019, United Nations Department of Economic and Social Affairs

2. Ageing and Wellness in Asia, Asian Development Bank

3. The March of Private Health Care in Southeast Asia, Think Global Health, 17 January 2020

4. China’s Healthcare Market Is Booming, With Ecosystems Taking Shape, GenRe, 10 August 2021

5. Private Healthcare in India: Boons and Banes, Institut Montaigne, 3 November 2020

Worldbox Business Intelligence is a global solution provider of business intelligence and data analytics, headquartered in Zurich, Switzerland with research operations around the world.

Write a comment

Willis (Wednesday, 22 June 2022 21:29)

Interesting points

Would be interesting to see the comments on Europe

The USA would be different - but for other reasons - can we get some input from this geographic areas?