SUMMARY

Overall Score 22 - Stable

Political risk: Stable 8/10

Economic risk: Stable 7/10

Commercial risk: Stable 7/10

The risk assessment of a country is made up of 3 components, being Political, Economic and Commercial. Each component is scored out of 10 with 1 being the lowest risk and 10 the highest.

Political Risk - Stable 8

There are few obvious challenges to Vietnam’s continuing political stability. Vietnam is a one-party state ruled by the Communist Party of Vietnam (CPV) and one of the most stable countries in Southeast Asia. Since the CPV adopted the Doi Moi (open door) policy in 1986, shifting from a centrally planned economy to a market-oriented one, the country has been transformed and tens of millions lifted out of poverty. Vietnam has regularly posted annual GDP growth of 6–8 per cent over the past decade.

Nguyen Xuan Phuc was appointed to the largely ceremonial post of president by parliament in April 2021, taking over from Nguyen Phu Trong. However, Trong was re-elected to the powerful post of general-secretary of the Communist Party earlier in January, at the age of 76, for a rare third five-year term. Since taking office in 2011, Trong has built up a strong power base in the Communist Party. He won praise for the government’s handling of the COVID-19 crisis in 2020.

Trong has also led a “blazing furnace” crackdown on corruption over the past five years. However, some analysts believe the anti-graft campaign, which has seen several high-ranking ministers and politicians, including one Politburo member, handed prison terms on charges ranging from embezzlement to economic mismanagement, has been politically motivated to cement Trong’s position.

In 2019, Trong was reported to be suffering from health issues. There has been speculation that Trong may step down halfway through his third term. However, it is unlikely that there will be any significant policy changes following any change of leadership.

Economic Risk – Stable 7

Vietnam entered the pandemic with solid economic fundamentals and policy buffers, according to the IMF. The country’s economic model has been built on attracting foreign investment to drive the transformation from agriculture to a modern economy based on manufacturing. Strong foreign investment and current-account surpluses have strengthened the external position.

At the same time, the health of the banking system has improved, boosting profitability and liquidity, and reducing non-performing loans. The country has also made considerable progress in consolidating its public finances and has chalked up some of the fastest growth rates in the world in recent decades. However, despite these favourable outcomes and ongoing structural reforms, there is still significant room to boost productivity and improve economic resilience.

Vietnam has increasingly opened itself to global trade. Trade has almost quadrupled over the past decade and is now more than twice the size of the economy. The IMF argues that more decisive reforms are needed to make the most of Vietnam’s considerable growth potential. This would include tackling the sources of pervasive low productivity “with reforms geared towards reducing [the] regulatory burden faced by firms, improving their access to resources, enhancing governance and access to technology and innovation, and reducing skills mismatches”.

However, Vietnam should remain one of the fastest-growing economies in the Asia-Pacific region, benefiting from a large and skilled labour force and still relatively low wage costs.

The country is the main low-cost regional alternative to China for export-orientated manufacturing. It has benefited from Sino–US tensions and rising wages in China: many companies have shifted export manufacturing – especially in ready-made garments, and increasingly in consumer goods and ICT products – from China to Vietnam. The country has also gained from the trend to move production away from China because of the coronavirus-related supply-chain disruptions seen in 2020.

Vietnam gained plaudits for its initial response to the outbreak of the pandemic in early 2020. The rapid introduction of containment measures, combined with aggressive contact tracing, targeted testing, and isolation of suspected COVID-19 cases, helped keep recorded infections and death rates notably low on a per capita basis. The economy expanded by 2.9 per cent last year at a time when other Southeast Asian countries plunged into recession.

Since late April 2021, however, the pandemic has ravaged Ho Chi Minh City (HCMC), the country’s commercial dynamo, claiming more than 15,000 lives. Lockdowns in HCMC precipitated a severe downturn in the economy, and in October 2021 the World Bank lowered its 2021 GDP growth forecast for Vietnam to between 2 per cent and 2.5 per cent, from 4.8 per cent in August. The Singapore-based financial-service supplier DBS, meanwhile, forecast growth of just 1.8 per cent.

Commercial Risk - Stable 7

Vietnam ranks 70th out of 190 countries in the World Bank’s Ease of Doing Business index, having moved up from 90th place in 2010. It remains well below other Southeast Asian economies such as Malaysia and Indonesia. The country ranks lowest in terms of starting a business, paying taxes, trading across borders and resolving insolvency. It takes businesses 384 hours to pay taxes in Vietnam, compared with 64 hours in Singapore, 174 hours in Malaysia and 191 hours in Indonesia. The World Bank also found that the main challenge facing domestic businesses was gaining access to credit.

That may well explain why corporates in Vietnam – particularly the small and medium enterprises that dominate the hardest-hit sectors – entered the crisis with relatively weak balance sheets, according to the IMF. COVID-19 has further deteriorated their liquidity and solvency positions, raising financial-stability concerns through bank exposures. However, the IMF adds that monetary, fiscal and financial-sector policies implemented by the government have helped mitigate the immediate risk of a surge in corporate defaults and mass layoffs.

Corruption is a significant challenge. Vietnam ranks joint 104th out of 180 countries in Transparency International’s 2021 Corruption Perceptions Index, together with Thailand, two spots behind Indonesia. According to the Vietnam Corruption Report by GAN, corruption is pervasive in Vietnam’s business environment. It adds that companies are likely to experience bribery, political interference and facilitation payments in all sectors. However, land administration, the construction sector and public administration are especially prone to corruption, according to GAN.

The country ranks in 90th place in terms of economic freedom, according to the Heritage Foundation’s 2021 Index. Its overall score increased by 2.9 points, primarily because of an improvement in fiscal health. Vietnam is ranked 17th among 40 countries in the Asia–Pacific region, and its overall score is above the regional and world averages.

The lack of adequate infrastructure provides significant challenges to operating in Vietnam. Just 20 percent of the country’s national roads are paved. The population growth in major cities in recent years has strained and exceeded the capacity of the existing infrastructure. Vietnam also lacks adequate infrastructure connecting roads with seaports, resulting in logistics costs being insufficiently competitive.

February Bulletin

Political Risk – No Change

The government faces no significant threats to its rule. Former president Nguyen Phu Trong, who was re-elected to the post of general secretary of the Communist Party in January 2021, is the most powerful figure in the country. However, Trong is now 77 and not in good health, and he may step down in the next couple of years. That is unlikely to disturb Vietnam’s political stability, given the smooth transition of leadership that has taken place in Vietnam when previous leaders have stepped down. There is also broad support for the current economic policies that have served Vietnam so well over the past few decades.

Economic Risk – No Change

At the start of October, Vietnam lifted social distancing curbs across the country, allowing businesses to resume economic activity. The lockdowns precipitated by the third wave of COVID-19 that gripped Ho Chi Minh City from April onwards severely damaged the economy, which shrank by 6.17 per cent in the third quarter on an annual basis. Nationwide, 4.7 million Vietnamese lost their jobs during the third quarter of the year.

The Vietnam Textile & Apparel Association had predicted that many of the 2.000,000 textile workers will only return to the factories after the Tet holiday of February, and recent reports confirmed this with 85-90% of employees returning.

In January 2022, the World Bank stated the 2021 GDP growth for Vietnam was 2.6 per cent, from 4.8 per cent forecast in August. The Singapore-based financial-service supplier DBS predicted that Vietnam’s economic growth may reach 8 percent next year, thanks to rising flows of foreign direct investment and exports, and the impetus towards digitalisation.

Commercial Risk – No Change

Many Vietnamese companies are facing significant operational, financial and strategic challenges due to the COVID-19 lockdowns, so counterparty risk has risen over the past year. Businesses need to evaluate the risk of infection and effectively manage their liquidity to survive this difficult period.

In an August 2021 report, Fitch Ratings warned that the impact of the pandemic is increasing asset-quality risks for banks. However, the ratings agency added that prior to the latest wave of infections Vietnamese banks had been riding on positive business momentum. Most banks reported brisk loan growth and a steady earnings recovery in the first half of 2021, providing them with greater buffers to withstand the potential slowdown and impairments in the remainder of the year. The agency also believes that the regulator is likely to relax debt-relief criteria for borrowers in the face of the virus’s resurgence. This, it says, “will reduce reported loan delinquencies and reduce required credit provisions, protecting profitability and capitalization”

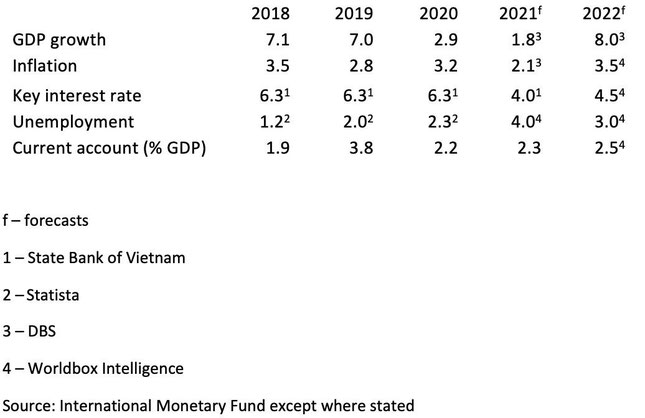

Latest economic data

About Worldbox Business Intelligence

An independent service, Worldbox Business Intelligence provides online company credit reports, company profiles, company ownership and management reports, legal status and history details, as well as financial and other business information on more than 50 million companies worldwide, covering all emerging and major markets.

Worldbox was founded in the 1980s, with the vision to become a global business provider. Its ability to deliver data in multiple languages in a standard format has strengthened its brand.

Source: Worldbox

Write a comment